Table of Content

- Chime App Review

- buy app store downloads

- ranking app store

- buy android app review

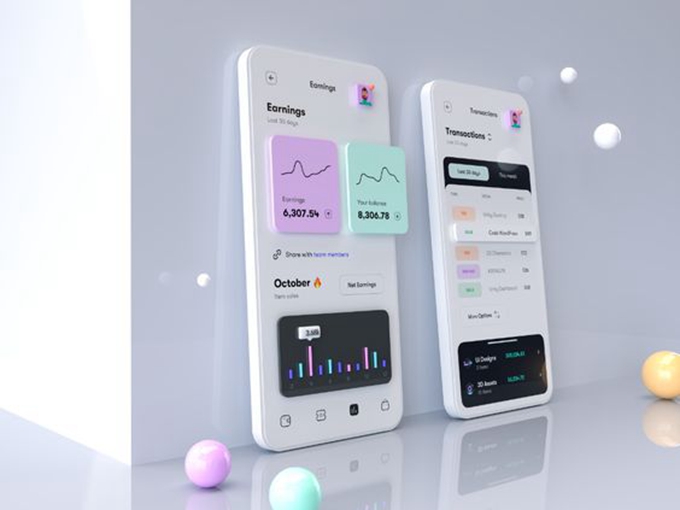

Customers want a Chime spending account to log into the app. Whereas all customers obtain a debit card, they might select to open financial savings or credit score builder accounts. Throughout the app, they will examine their account balances, switch cash, and handle their spending. Chime members don’t want to take care of a minimal steadiness.

What units the Chime app aside? A clear interface and superior cash administration options, together with:

Cellular cost choices

In mild of Covid-19, no one needs to the touch surfaces they don’t completely have to. The Chime app features a cell pockets so there’s no have to deal with a bodily card or card reader.

Chime can join with both Apple Pay or Google Pay. No extra charges are charged for cell funds.

You may also ship cash to different pals who use the Chime app. Pay Buddies makes splitting a examine for lunch a chunk of cake, eliminating the necessity to entry an ATM or pull out your card.

Prime-notch safety

The Chime app places a premium on safety and management. Two-factor authentication, biometric entry controls, 128-bit AES encryption, and safe switch protocols maintain unauthorized customers from gaining entry.

One other key safety function of the Chime app is its transaction blocker. In case your card is misplaced or used with out your permission, you possibly can toggle a swap within the app to dam all transactions.

That can assist you maintain an eye fixed out for unauthorized transactions, the Chime app supplies real-time alerts. Any time your Chime card is used, you’ll obtain an on the spot transaction alert.

Early entry to funds

Within the Chime app, you possibly can arrange direct deposit. Once you open an account, you’ll obtain a type you may give to your employer. Return it, and you will get your paycheck as much as two days early.

When you shouldn’t use early funds as an excuse to go on a procuring spree, getting your cash just a little early may give you some peace of thoughts. Use it to pay your payments immediately from the Chime app.

Should you do run a bit quick, Chime has a SpotMe function for eligible members. SpotMe covers overdraft charges on debit card purchases as much as $100, with the choice to pay it ahead with a tip as soon as your account steadiness is again in constructive territory once more.

Computerized financial savings

You probably have each a spending and a financial savings account with Chime, you possibly can allow a function known as Save When You Spend. Save When You Spend rounds up purchases to the closest greenback and places that spare grow to be your financial savings account.

Chime’s different automated financial savings possibility, Save When You Get Paid, permits you to set a certain quantity of your paycheck (as much as 10%) into your linked financial savings account. Each time you obtain a direct deposit, your financial savings account will get a lift.

Almost 300,000 evaluations have been left within the Apple App retailer in regards to the Chime app, averaging a 4.8 out of 5 star score. Obtain the Chime app to rework the best way you financial institution.